.webp)

As a crypto startup founder, you're probably laser-focused on finding that elusive product/market fit. You're building product, talking to users, and trying to create something people actually want.

But there's another crucial aspect of your business that demands attention: accounting and finance.

You probably dread it, or at least find it a distraction from the "real" work of building your product. I know I did at first when I started Stackup. But understanding the basics of accounting, especially the unique complexities of crypto accounting, helps you make informed decisions that can make or break your startup.

In this guide, we'll dive into everything you need to know about finance and accounting as a crypto founder.

Interested in this topic? I also write a guide to starting a crypto company in the US and our guide to crypto compensation.

Why Accounting Matters for Your Crypto Startup

The majority of startups don't fail because their idea was bad or the market wasn't ready; they fail because they run out of runway, mismanage their cash, or make poor decisions due to a lack of accurate data. According to CB Insights, 38% of startups fail because they run out of cash or fail to raise new capital. This is almost always because they ran out of cash before finding product/market fit.

Y Combinator's Paul Graham once said, "Startups die of suicide, not murder." Startups die because they spend their money too fast on the wrong things, not because they were out-competed.

Startups die of suicide, not murder

- Paul Graham

For crypto startups, this risk is amplified. You're not just managing USD in a bank account. You're juggling volatile tokens, complex vesting schedules, and regulatory uncertainty. But with the right financial foundation, these complexities become manageable.

The Three Numbers Every Crypto Founder Must Track

Before diving into complex financial statements, let's start with the three numbers that can kill your startup if you ignore them:

1. Burn Rate

Your burn rate is how much money you're spending each month beyond what you're earning.

Formula: Monthly Burn = Money Out - Money In

If you spend $80,000 per month and earn $20,000, your burn rate is $60,000. For crypto startups, this gets complex because "money" might include:

- USD in your bank account

- Stablecoins (USDC, USDT) in your treasury

- Your own token (if liquid)

- Other crypto assets

Pro tip: Calculate burn rate using only liquid assets. That million dollars worth of your own locked tokens doesn't count if you can't sell them.

2. Runway

Your runway is how many months you can survive at your current burn rate.

Formula: Runway = Total Liquid Assets ÷ Monthly Burn Rate

If you have $500,000 in combined USD and stablecoins and burn $50,000 monthly, you have 10 months of runway. Most VCs want to see 12-18 months of runway after funding, giving you time to hit milestones and raise your next round.

3. Growth Rate

For crypto startups, growth might mean:

- Revenue growth (for protocols taking fees)

- TVL (total value locked) growth (for DeFi protocols)

- Active wallet growth (for consumer apps)

- Transaction volume growth (for infrastructure)

Pick the metric that best reflects real usage of your product, not vanity metrics. YC recommends using revenue as the top level company metric in almost all cases, as it is a stronger indication that someone is getting value from your product.

A good benchmark is 15% month-over-month growth rate, which compounds to 5x annual growth.

Setting Up Your Crypto Accounting System

While you may know the burn rate, runway, and growth rate of your company, as these are the existential metrics for your company, you’ll need to go a step deeper to manage how your company operates.

You don't need to do accounting yourself, but you do need to ensure it's done right. Here's what a proper crypto accounting system looks like:

Finding the Right Accountant

You need an accountant who understands both traditional startup accounting and crypto-specific challenges. They should be familiar with:

- Token vesting schedules and their tax implications

- Multi-chain transaction reconciliation

- DeFi protocol interactions

- The latest FASB guidance on crypto assets

- International tax implications of token sales

Many traditional accountants will claim they can handle crypto. Test them by asking something relevant to your businesses. If you’re a liquidity provider, you can ask how they'd account for liquidity provider tokens or impermanent loss. If they look confused, keep searching.

Bookkeeping vs Accounting

Before we get into the granular details of crypto accounting, let’s start by differentiating between bookkeeping and accounting. Bookkeeping involves transaction management, while accounting focuses on interpreting the information bookkeepers enter.

For example, a bookkeeper might categorize transactions. An accountant will use those categorized transactions to generate financial statements to evaluate results.

Bookkeepers often rely on your team to complete a majority of the backend data entry for crypto-specific transactions. Due to the high levels of data, it’s not uncommon to spend five hours a week filling out a spreadsheet of transactions if you don’t have a tool that does it for you, like Stackup.

Outside of crypto-specific transactions, you still need to manage other financial transactions by using accounting software. For traditional vendors, most modern banking tools will include a merchant code with the transaction, allowing the bookkeeper to quickly classify the transaction. As a business leader and founder, it’s up to you to select the right tech stack for your accounting team. Here are some suggestions:

Your Crypto Finance Stack

A modern crypto startup needs both traditional and blockchain-native financial tools:

Traditional Side:

- Business bank account (such as Mercury)

- Accounting software (QuickBooks or Xero)

- Payroll software (Gusto or Rippling)

- Cap table software (Pulley or Carta)

- Tradfi payments provider (such as Stripe, if applicable)

Crypto Side:

- Treasury wallet (such as Stackup)

- Crypto accounting software (if not provided by your treasury wallet)

- Crypto payments provider (such as Stackup)

- On-chain analytics (Dune, Nansen for tracking protocol metrics)

The key is connecting these two worlds. Your crypto accounting software should integrate with your traditional accounting system, automatically categorizing on-chain transactions and syncing them to your books. Stackup automatically categorizes transactions to integrate with traditional accounting software, but other treasury wallets like Safe or Fireblocks will require manual reconciliation or additional software.

Your Bank

Despite regulatory changes in the US, many banks still won't touch crypto companies. Your options include:

- Crypto-friendly banks: Mercury, Customers Bank

- Fintech solutions: Brex, Ramp (with restrictions on crypto activity)

- International banks: Swiss or Singapore banks for larger startups

Many successful crypto startups operate primarily in stablecoins, converting to fiat only when absolutely necessary.

The Three Main Financial Statements

There are three main financial statements that you need to know: the income statement, the balance sheet, and the statement of cash flows. Let’s break down the main components of each of these statements.

Income Statement

The income statement shows you how profitable your crypto company is by outlining your revenue and expenses. There are a handful of different categories on this statement, including:

- Revenue – The money you earn and keep. A crypto company’s main source of revenue is often a combination of protocol fees, token sales, and subscription revenue.

- Cost of Goods Sold – Direct costs related to your primary source of income. For a crypto company, this might include software development wages, infrastructure costs, and gas fees.

- Operating Expenses - The cost of building and running your business. This often includes engineering salaries (usually your biggest expense), marketing and community building, legal, audit fees, and token incentives and grants (recorded as they vest).

- Other Income and Expense – Outlier expenses, like a one-time currency exchange loss or interest expense, will be listed in this category.

Your income statement will break each of these categories down further based on the specifics of how your business runs. For example, if you advertise and have a sales team, these expenses will often be listed as Selling Expenses under Operating Expenses.

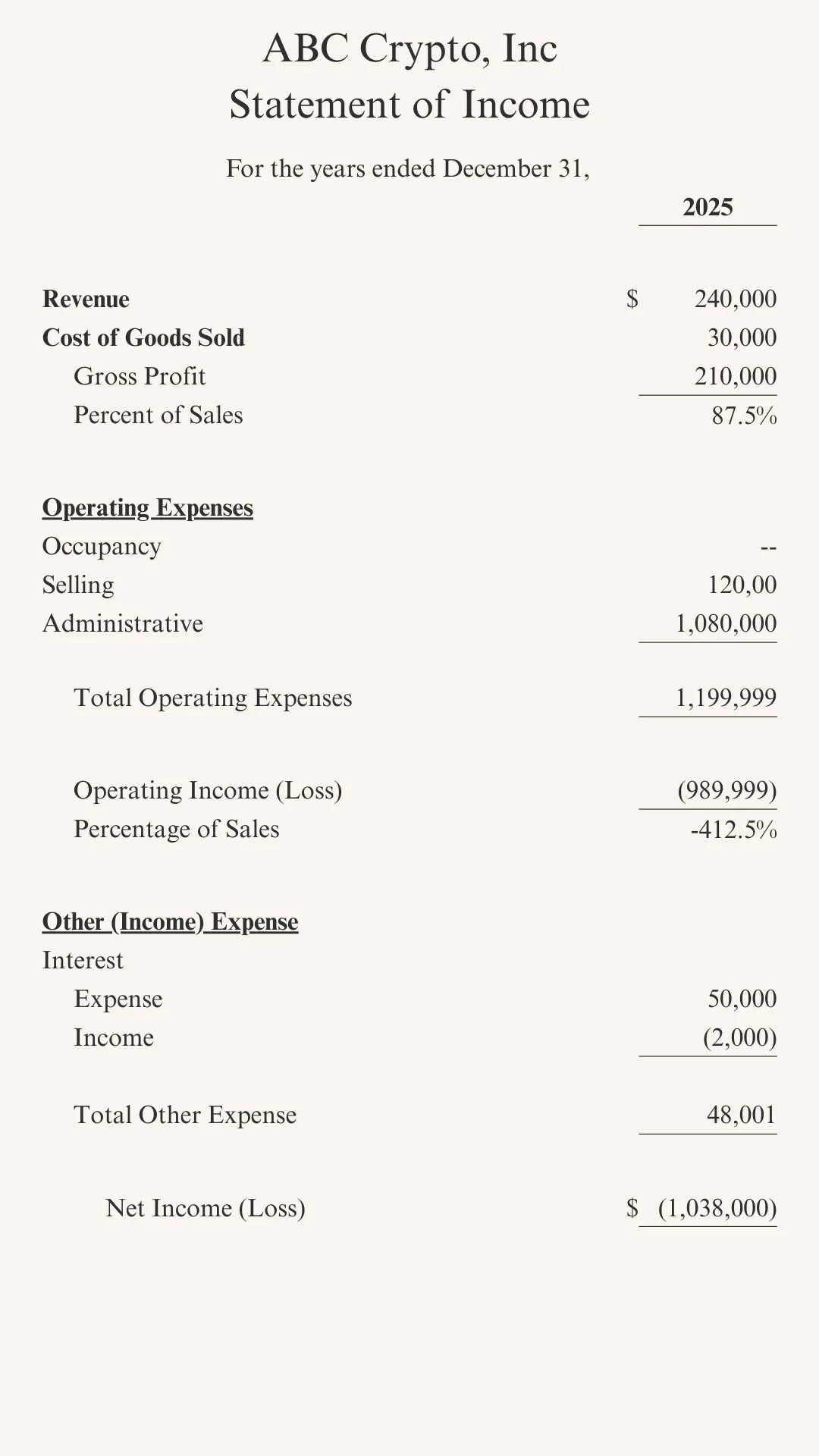

Below is a sample income statement of an early-stage crypto company.

Other than your company's overall growth, the bottom-line number on the income statement is what most business owners and investors are concerned about. The net profit or loss tells you how profitable you were for the reporting period. It's effectively your burn rate for that period.

Income Statement vs Comprehensive Income

The income statement includes realized gains and losses. But sometimes you will want to also track the unrealized gains and losses, especially of crypto assets. These are captured in a Statement of Comprehensive Income.

The IRS sees crypto assets as intangible assets. This means they are not considered cash or financial instruments. Instead, crypto assets are reported at their fair market value, which is generally the trading price at the close of the period. Recognized gains and losses aren’t treated as “real,” such as a deferred gain.

For this reason and others we show later, it is best to keep your treasury in stablecoins as much as you can. This is part of the reason Stackup pays for gas fees: it’s much easier to do accounting when you don’t have to track a blockchain’s gas token in your wallet.

If all of this is a little confusing, don’t worry. Your accountant will help you out.

Balance Sheet

The balance sheet shows what you own (assets), what you owe (liabilities), and what's left for owners (equity).

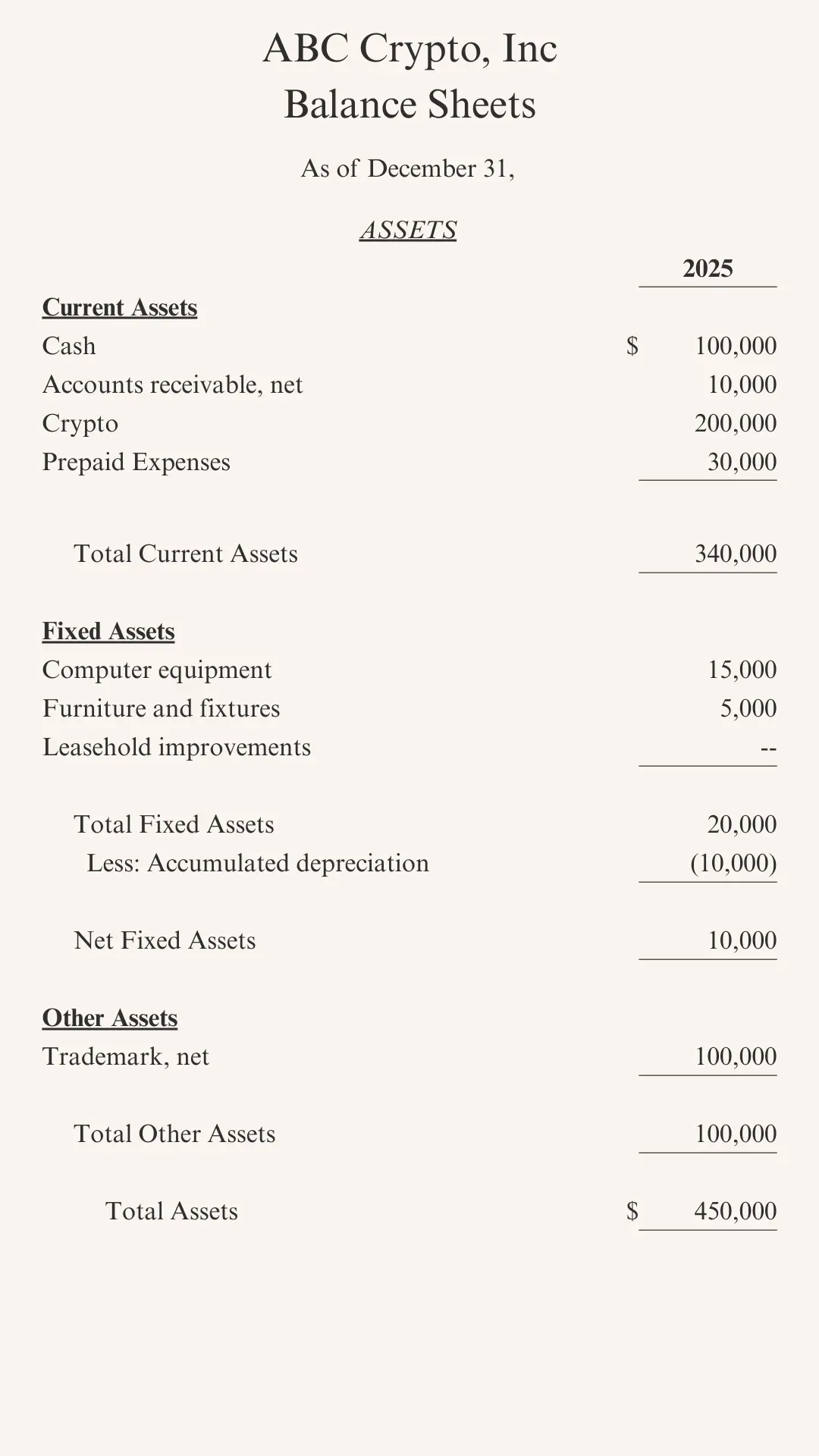

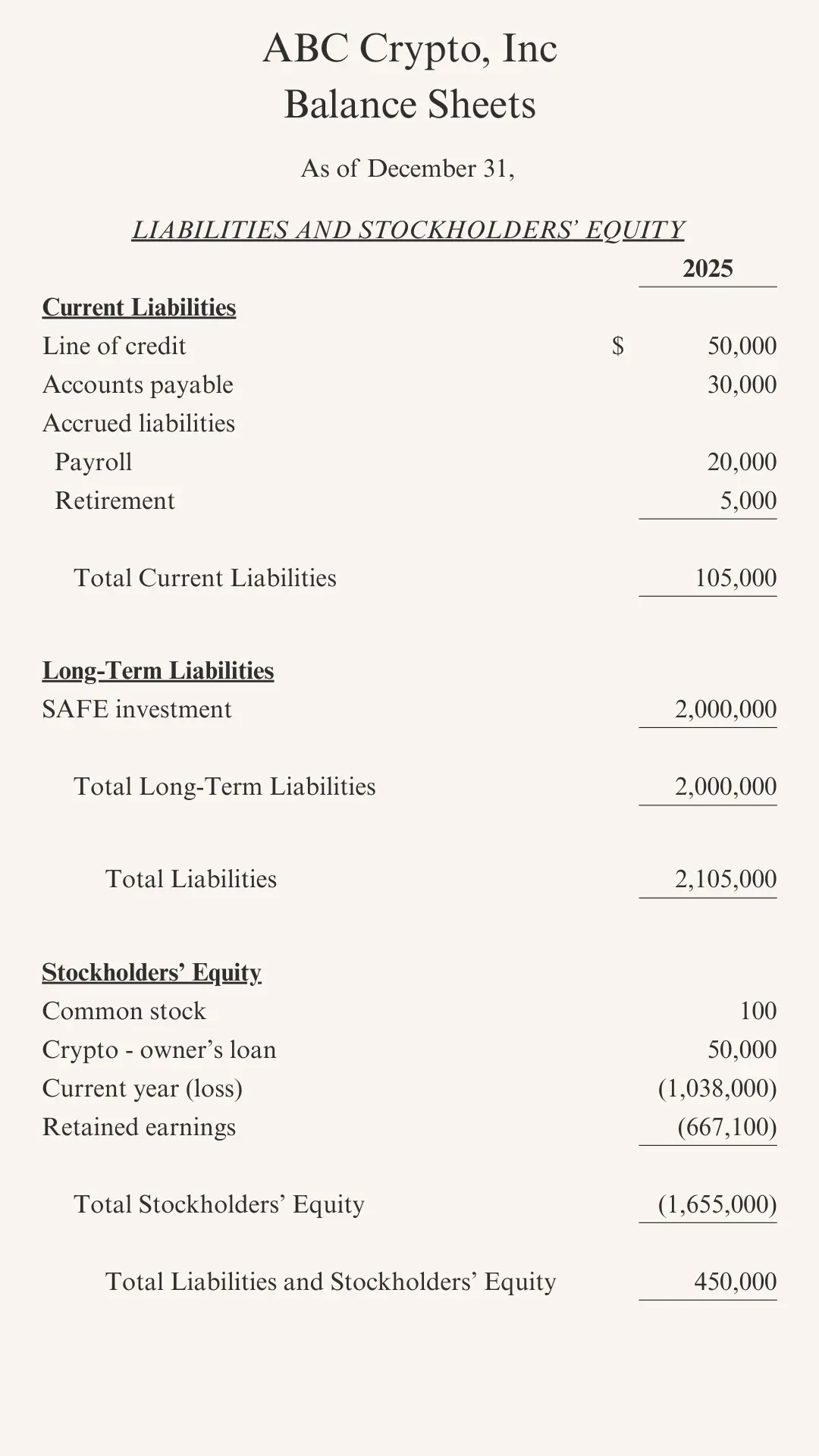

Below is an example of an early-stage crypto company’s balance sheet.

One of the key components of the balance sheet is what is known as the accounting equation. This equation states that assets must equal liabilities plus equity. If it doesn’t, it means that something is wrong with your financial statement. Looking at the above financials, we see that total assets do equal total equity and liabilities.

Assets are everything you own, such as the value of your crypto, cash, receivables, prepaid expenses, and other fixed assets.

Crypto-specific assets might include:

- Cryptocurrencies and tokens held in treasury

- LP tokens from liquidity provision

- NFTs (if material to your business)

- Smart contract deposits

It is easiest to keep on chain funds as stablecoins to avoid the headache of tracking the cost basis and swap value of every single little token on your balance sheet.

If your project has a token, things are a little trickier:

- Tokens in treasury (unvested): Generally not recorded as assets since you created them

- Tokens vesting to team/investors: Recorded as compensation expense as they vest

- Tokens held for liquidity/operations: May be recorded at fair value if you can sell them

For example, if you grant 1 million tokens to an employee vesting over 4 years, and tokens are worth $1 each, you'll record $250,000 in compensation expense annually as they vest.

Liabilities are everything you owe, including notes payable, convertible debt, accounts payable, and wages payable.

Beyond traditional payables and debt, crypto startups might also have:

- SAFTs (Simple Agreement for Future Tokens) - treated as liabilities until tokens and equity are delivered

- Token warrants attached to SAFEs

- Obligations to provide liquidity or stake tokens

- Smart contract liabilities (like insurance fund obligations)

Equity is more complex. Equity includes past earnings and losses, dividend payments, other comprehensive income, and issued capital. Equity changes can be issued as a separate financial statement, but the final numbers are reported on the balance sheet.

The Statement of Cash Flow

The statement of cash flow analyzes how your cash is being spent by tracking changes in your cash accounts for a specified time period, such as one month or one year. This statement is broken down into three main categories:

Cash Flows from Operating Activities includes cash transactions from normal operations, such as increases or decreases in assets and liabilities.

Cash Flows from Investing Activities – This category outlines your cash earned or spent from investing activities, such as proceeds from asset disposals, purchase of fixed assets, and other intangible investments. For a crypto company it will also include purchases of tokens for your treasury, yield farming or staking activities, and liquidity provision.

Cash Flows from Financing Activities – This category shows all of your financing activities, including dividend payments and loan payments or proceeds. It also includes SAFE or equity rounds, sales of your project’s token, and employee option exercises.

At the end of the statement, all of the above transactions should equal the net change in your cash account from the beginning to the end of the period.

Cash vs Accrual Accounting

The main financial statements can be generated based on two main reporting methods: cash or accrual.

Let’s break down the main differences between these two accounting methods and determine which is preferred for crypto business owners.

Cash Basis of Accounting

The cash basis of accounting only records transactions when cash is deposited or leaves your bank account. This method does not track receivables or payables, making it easier to keep track of transactions and true margins. For example, you may be expecting a large deposit on December 31. If this transaction doesn’t clear until January 1, it would be deferred to the next year, potentially causing inaccuracies in your financials.

Accrual Basis of Accounting

The accrual basis of accounting records transactions based on contractual obligations. Once contractual obligations are satisfied, the transaction is entered. Taking our above example, the large deposit would be recorded as of December 31 as a receivable.

There are a few reasons why the accrual basis of accounting is the go-to method for early-stage companies:

- Accurate Financials – Since transactions are recorded when they are essentially complete, your financial statements have more accuracy. This gives you clearer insights into your profit margins and operational efficiency.

- Improved Decision Making – With all of the relevant company numbers in front of you, you can make more agile and informed decisions. For example, if your balance sheet doesn’t show an upcoming payable, you may believe you have more cash on hand than you truly do.

- Boosts Investor Confidence – Investors want to see your full financial picture. The cash basis of accounting leaves out key details, like payables and receivables, which is why the accrual basis of accounting is the preferred method.

- Capital Raising Activities – If you plan on taking your crypto company public, the accrual basis of accounting is an approved GAAP method. This means that if you need a review or audit, your financials will need to use the accrual method.

Most accounting software programs give you the option to generate reports using both accounting methods. However, when receiving reports from your bookkeeper, be sure to evaluate the income statement and balance sheet using the accrual method.

Crypto Finance Best Practices

Managing the finances in your crypto business can feel like a distraction. However, it’s an integral component of running a successful company. Here are some recommendations from our experience running a crypto company and working with many others.

Stay Consistent with Accounting

Staying consistent with routine accounting tasks saves you a lot of time and reduces mistakes in your financial statements. It can be a pain to figure out the context of a transaction months after you’ve made it. It’s much easier to go back and categorize transactions from last month compared to six months ago.

Here are some crypto accounting best practices broken down by frequency.

Weekly

- Track cash flow and your bank balance

- Update crypto transaction spreadsheets or verify automation is still working in your system

Monthly

- Check loan and bank balances

- Review internal financial statements

- Review compliance and upcoming deadlines

- Back up financial data

Quarterly

- Consult with a tax accountant on estimated tax payments

- Hold investor and shareholder meetings to review financial results

- Forecast upcoming accounting periods

- Prepare for any large purchases

Annually

- Write off uncollectible receivables

- Generate annual financial statements

- Close the year with proper cut off

- Prepare for tax time

Separate Personal and Company Systems

At times it may be tempting to use personal accounts to move money onchain. However using a personal Coinbase account or hardware wallet creates an accounting nightmare down the road. Even if it feels slow at first, opening new exchange accounts for your company and creating dedicated wallets (like Stackup) will save you a lot of time.

Keep Compensation Consistent

With crypto companies operating across many geographies, and talent being scarce, it can be difficult to keep employee compensation fair and defensible. This is a broad topic, so we’ve compiled some advice into a dedicated guide to crypto employee compensation.

Keep Track of Tax and Compliance Filings

You can get in a lot of trouble if you don’t file taxes on time. Your accountant will help you keep track, but you should keep a separate calendar or at least remember the key dates. The filings will be different depending on your geography and corporate structure.

In the US, a Delaware C-Corporation will need to make the following filings:

- Form 1120: US Corporate income tax. It may include additional forms, such as 5472 for companies with foreign owners. Due April 15.

- Form 7004: Tax filing extension that delays the required Form 1120 filing from April to October. Due April 15.

- Form 1099 and W-Series: Compliance filing for non-employer payments. Due January 31.

- FinCEN Beneficial Ownership Information: Compliance filing for reporting the Company's owners to FinCEN. Due January 1.

- State Franchise Tax: Due March 1.

- State Statement of Information: You may need to give additional information to states you are doing business in. Due dates vary.

- City Business Tax Certificate: You may need to pay for a local business license for the city you do business in. Due dates vary.

The tax treatment of tokens varies by jurisdiction and structure. In the US, tokens are property for tax purposes and every transaction is a taxable event. This means you need to track the cost basis of every token. If you have many tokens, this can be a nightmare. We recommend keeping your onchain funds as stablecoins where possible.

Many crypto companies have an international structure, especially if they have a protocol token. Often this means they have a US Delaware C-Corp that manages equity and operations, and an offshore entity for token issuance. This requires transfer pricing agreements and careful tax planning. Offshore entities are often in the British Virgin Islands or Cayman Islands.

Common Crypto Accounting Pitfalls

Here are some of the expensive mistakes we’ve found early-stage crypto companies make:

Mixing Personal and Company Wallets

Never use the same wallet for personal and company funds. It is tempting at the beginning of a project, since this is the lowest friction way to get funds onchain, but it creates tax nightmares, audit complications, personal liability exposure, and becomes really difficult to reconcile.

If you use personal onchain funds to kick start your business, we strongly recommend putting them into a new wallet.

Ignoring Gas Fees

Gas fees are tax-deductible expenses, but only if you track them. A DeFi protocol might spend millions in gas annually—don't leave that deduction on the table. Stackup takes care of gas fees for you, so you don’t have to worry about tracking this expense.

Forgetting About Impermanent Loss

If you're providing liquidity, impermanent loss is generally not deductible until realized. You must track how the value of your liquidity position changes, and understand that withdrawal of your position triggers recognition of a gain or a loss that must be accounted for.

Token Incentives

Token incentives to users should generally be treated as marketing expenses, not COGS. Misclassifying these can distort your gross margins, create tax issues, and confuse you and your investors about the unit economics of your business.

Improper Classification of Revenues

Revenue is one of the most important metrics in your business. While misclassifying revenue is not very common, it can be a huge problem. Common mistakes include:

- Recognizing token appreciation as revenue

- Recognizing SAFT proceeds as revenue before token delivery

- Recording gross transaction volume or TVL instead of fees

The Path Forward

You don’t need to master accounting to build a successful company, but you do need to build a financial foundation that lets you focus on product and growth. The unique challenges of crypto accounting, from volatile treasuries to complex token economics, require new tools and approaches, but the fundamentals remain the same: know your numbers, manage your burn, and always have a plan for your next dollar (or stablecoin).

Remember: every successful crypto project, from Uniswap to OpenSea, had to figure this out. They all started with spreadsheets and multisigs, gradually building sophisticated financial operations. You're not alone in this journey.

The crypto startups that succeed will be those that marry innovation with financial discipline. They'll track both their AWS bills and their gas costs, manage both their equity cap table and their token vesting schedule, and build products that generate real revenue, not just token appreciation.

Ready to take control of your crypto startup's finances? Start with the basics. Calculate your burn rate and figure out what your major expenses are. Find that crypto-native accountant. Your future self will thank you.

Want help streamlining your crypto financial operations? Stackup helps crypto startups grow their onchain finances with enterprise-grade controls and smooth payment workflows.

John Rising

John Rising is the co-founder and CEO of Stackup, a digital asset management platform designed to streamline crypto operations for enterprise-grade businesses. Prior to founding Stackup in 2021, John began his career in aerospace engineering, where he managed missions at SpaceX, led vehicle design at Relativity Space as its first employee, and helped design the propulsion systems in Virgin Galactic’s SpaceShipTwo.

John holds a master’s degree in engineering and management from MIT and a bachelor’s degree in engineering from USC. At Stackup, John leverages his technical expertise to champion and simplify enterprise adoption of blockchain technology, making the industry more accessible to businesses and end users alike.